In the running up to the company’s six-month financial announcement, NBN Co indicated that it would start in April rolling out its latest rebate campaigns — under the themes “Step Up” and “Light Up”.

They aim to attract new connections and migrate existing users from low to mid-level speeds. The offers are again only temporary and are for a six-month period only; after that, the full price applies.

The rebates are provided to the RSP (retail service providers), who then will use them to make special offers to their own retail customers:

- upgrades from 12Mbps to 25Mbps receive an $8 rebate;

- upgrades from 12Mbps to 50Mbps, or the 25-50 tier for FTTN/FTTB, get a $10 rebate;

- upgrades from 25Mbps to 50Mbps or from fixed wireless to Wireless Plus get a $2 rebate; and

- in May, a second package will be made available for upgrades to 100/40 services.

As we discussed on several occasions, the company has been plagued by ongoing requests from its regulators, retailers and consumer organisation to come up with better pricing schemes. The Australian Competition and Consumer Commission (ACCC) is still investigating NBN Co’s complex wholesale charging system. Consumer organisations have also made it a political issue arguing that people who can’t afford broadband should still get it as it is essential for their social and economic existence.

Of course, the company keeps arguing that it should be allowed to build a financially viable business and I don’t think that anybody would disagree with that. However, the issue is that its cost base is far too high and that retailers and consumers are paying the price for the political footballing with the NBN, which has resulted in costs much higher than were originally envisaged by the then Minister for Communication, Malcolm Turnbull. He had mentioned costs between $25–29.5 billion and the current costs are running towards $70 billion.

To placate the retailers and consumers, the company has been offering on and off a range of temporary rebates. This allowed it to maintain its overall pricing structure with some drip feeds to the market. The reason why NBN Co keeps dragging its feet on this issue is that it needs these higher prices to stay financially viable.

The discounts were appreciated during the COVID-19 pandemic, but it was not just charity as the pandemic has also seen customers forced to pay for higher quality plans, especially when home working and home education led to significant increases in the demand for broadband capacity within households.

NBN Co had not been able to reach its ARPU (average revenue per user) target of $52 by 2021. However, it has this time, after several years of flat growth, seen an ARPU increase from $45 to $46.

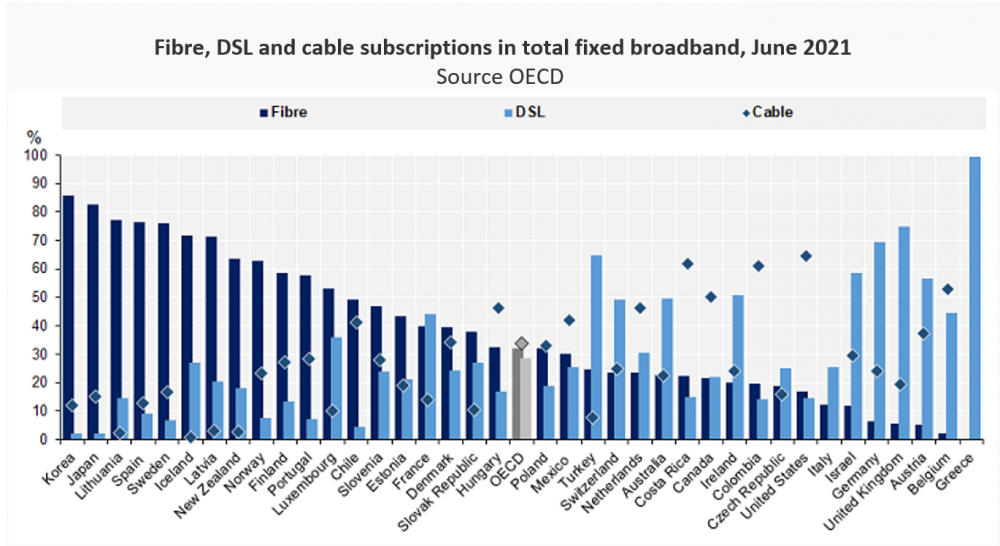

According to the ACCC, in September 2021 10.4% of NBN users had 12Mbps services and 12.4% 25Mbps. The majority however, 58%, were on 50Mbps, 19.2% used 100Mbps or faster products. The table above clearly shows Australia’s ongoing poor position on the international broadband ladder.

Furthermore, during my radio interviews with stations in regional and country areas, time and time again I hear mayor of towns, farmers and ordinary users complaining about the quality of the service, especially the fixed-wireless and satellite services are continuing to be a major problem area as are – be it at increasingly smaller numbers – the poor performing FttN services. Lack of stable mobile access remains the other major issue that plagues regional and rural communities across the country. Mobile access remains a hit and miss system outside metro Australia.

To finish of here are NBN Co’s latest financial figures:

- NBN Co connected approximately 190,000 additional premises in the six months to 31 December 2021 to close the half-year with 8.4 million premises connected to the network.

- The results will enable them to bring forward $4.5 billion of investment.

- It grew its business to an annualised run rate of $5 billion revenue and $3 billion EBITDA.

- It raised $5.6 billion private money, while reducing the outstanding debt owed to the federal government by $5.8 billion down to a $7.4 billion balance. The government originally loaned the operator some $19.5 billion.

- Revenue from its business customers surged to $493 million in H122, up 24% from $397 million year on year.

- Operating cash flow increased 27% to $1.52 billion while capex fell 19% to $1.16 billion with earning before subscriber costs was $1.63 billion.

Paul Budde